Our services

Debit management

Debt management allows you to get your debt under control through financial planning & budgeting. The goal of a debt management plan is to use these strategies to help you lower your current debt and ultimately move towards eliminating it entirely.

Retirement Planning

Retirement planning means preparing today for your future life so that you continue to meet all your goals & dreams independently. This includes setting your retirement goals, estimating the amount of money you will need, and investing to grow your retirement savings.

Estate Planning

Allow the Virtuous Accounting team to determine how your assets will be preserved, managed, and distributed after death. We will also take into account the management of your properties and financial obligations in the event that they become incapacitated.

College Funding

From Parent Plus loans to Financial Aid & scholarships never miss out on an oppurtunity to help your family pursue the path to higher education. Let the Virtuous Accounting team help your next generation of thinkers go to the university or college of their choice by letting us discuss your funding options.

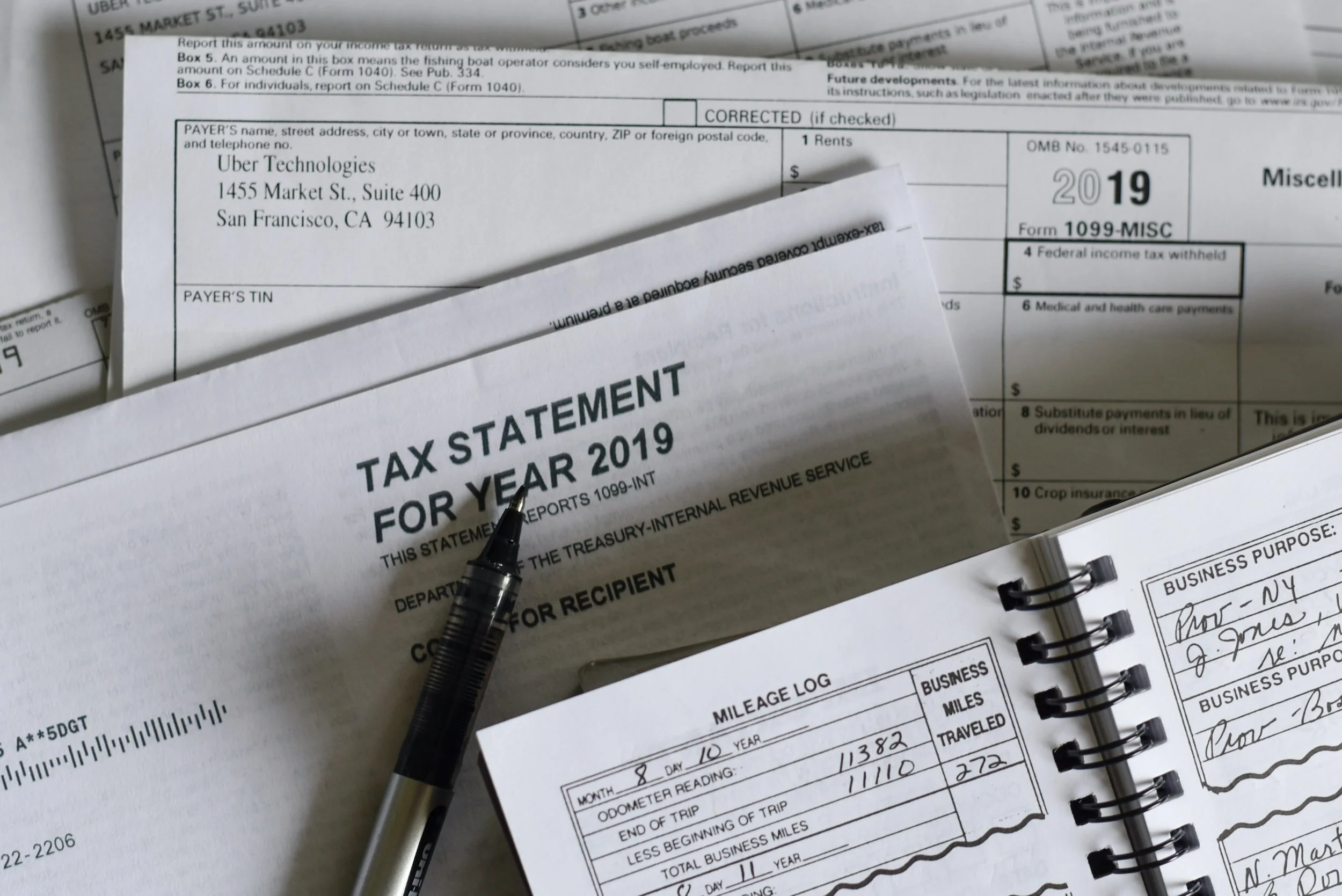

Tax Planning

Tax planning is when a client allows us to perform an analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. A plan that minimizes how much you pay in taxes is referred to as tax efficient.

Charitable Giving

A charitable donation is a gift of cash or property made to a nonprofit organization to help it accomplish its goals, for which the donor receives nothing of value in return. In the U.S., donations can be deducted from the federal tax returns of individuals and companies making them.

U.S. taxpayers are able to deduct donations equal to up to 60% of their adjusted gross income (AGI) annually. The IRS allows taxpayers to deduct donations of cash and property to qualified charitable organizations if you itemize your deductions.